child tax credit payment schedule irs

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible.

. IR-2021-153 July 15 2021. The payments will be paid via direct deposit or. The new advance Child Tax Credit is based on your previously filed tax return.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim. Dates for earlier payments are shown in the schedule below. The additional child tax credit may give you a refund even if you do not owe any tax.

Related

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. Ad File a free federal return now to claim your child tax credit. Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents.

Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child between ages 6-17 and 300 per child under age 6. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. Families who normally arent required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

Didnt Get Your Child Tax CreditHeres How to Track It Down. Take for example a family that received a total of 1800 in advance Child Tax Credit payments for their two-year-old child. How to Claim This Credit.

Up to 250 per month. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. 3 Tax Credits Every Parent Should Know.

Use Schedule 8812 Form 1040 to figure your child tax credits to report advance child tax credit payments you received in 2021 and to figure any additional tax owed if you received excess advance child. Most families nearly 90 of children in the United States will automatically receive monthly payments without having to take. Open a GO2bank Account Now.

Up to 7 cash back with Gift cards bought in-app. The Child Tax Credit Update Portal is no longer available. To reconcile advance payments on your 2021 return.

Ad Get Your Bank Account Number Instantly. This first batch of advance monthly payments worth roughly 15 billion. The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15.

The Child Tax Credit helps all families succeed. The Child Tax Credit provides money to support American families helping them make ends meet more easily. Get your advance payments total and number of qualifying children in your online account.

You can use this portal to look up information about your monthly payment amounts and also to manage any advance payments you may receive in the future. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021.

Use Schedule 8812 Form 1040 to figure the additional child tax credit. Payments begin July 15 and will be sent monthly through December 15 without any further action required. Payments start July 15 2021.

For each child under age 6 and. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families believed to be eligible to receive themFamilies can expect the next payment to roll out on Sept.

Lucky for us the IRS has created a website called the Child Tax Credit Update Portal CTC UP. The estimated 2021-2022 IRS refund processing schedule below has been updated. Will The Child Tax Credit Affect Your 2022 Taxes.

Enter your information on Schedule 8812 Form. When you file your 2021 tax return you can claim the. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments.

Eligible families began to receive payments on July 15. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. Up to 300 per month.

No monthly fee weligible direct deposit. Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child. Child Tax Credit Payment Schedule For 2021 Heres When Youll Get Your Money.

Eligible families can receive advance payments of. Set up Direct Deposit. From then the schedule of payments will be as follows.

For each child age 6 and above. From then the schedule of payments will be as follows. Additionally at some point in December of 2021 or January of 2022 youll receive a Letter 6419 from the IRS that will give.

Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in your 2019 or 2020 federal income tax return. 3 Tax Credits Every Parent Should Know. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic.

If they filed jointly as a married couple in 2020 each spouse should have gotten Letter 6419 from the IRS saying they received 900 in. 2021 Advance Child Tax Credit. Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

The schedule of payments moving forward is as follows. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

Irs Child Tax Credit Payments Start July 15

Irs Cp 08 Potential Child Tax Credit Refund

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

File Taxes For 2021 To Receive Your Full Child Tax Credit

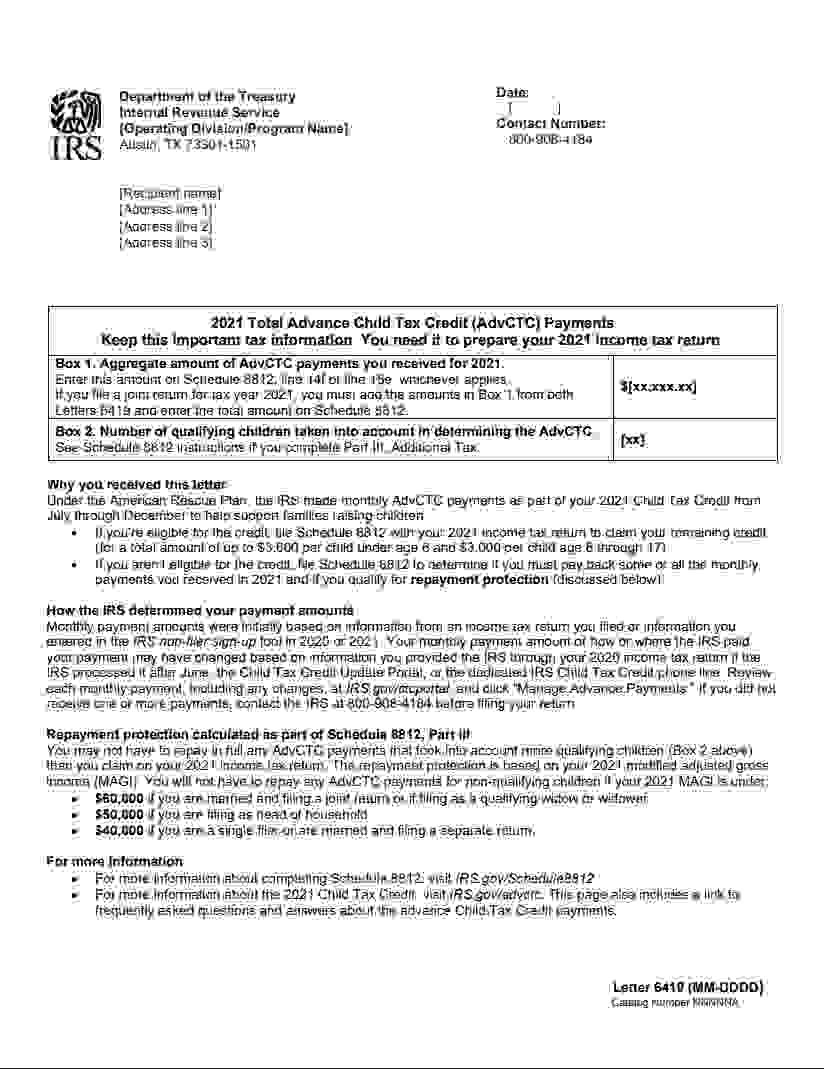

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit What We Do Community Advocates

Irs Urges Parents To Watch For New Form As Tax Season Begins

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Kokh

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Irs Taxes Irs Forms

2021 Child Tax Credit Advanced Payment Option Tas